Brexit: How Will the UK’s Exit from the EU Affect its Economy?

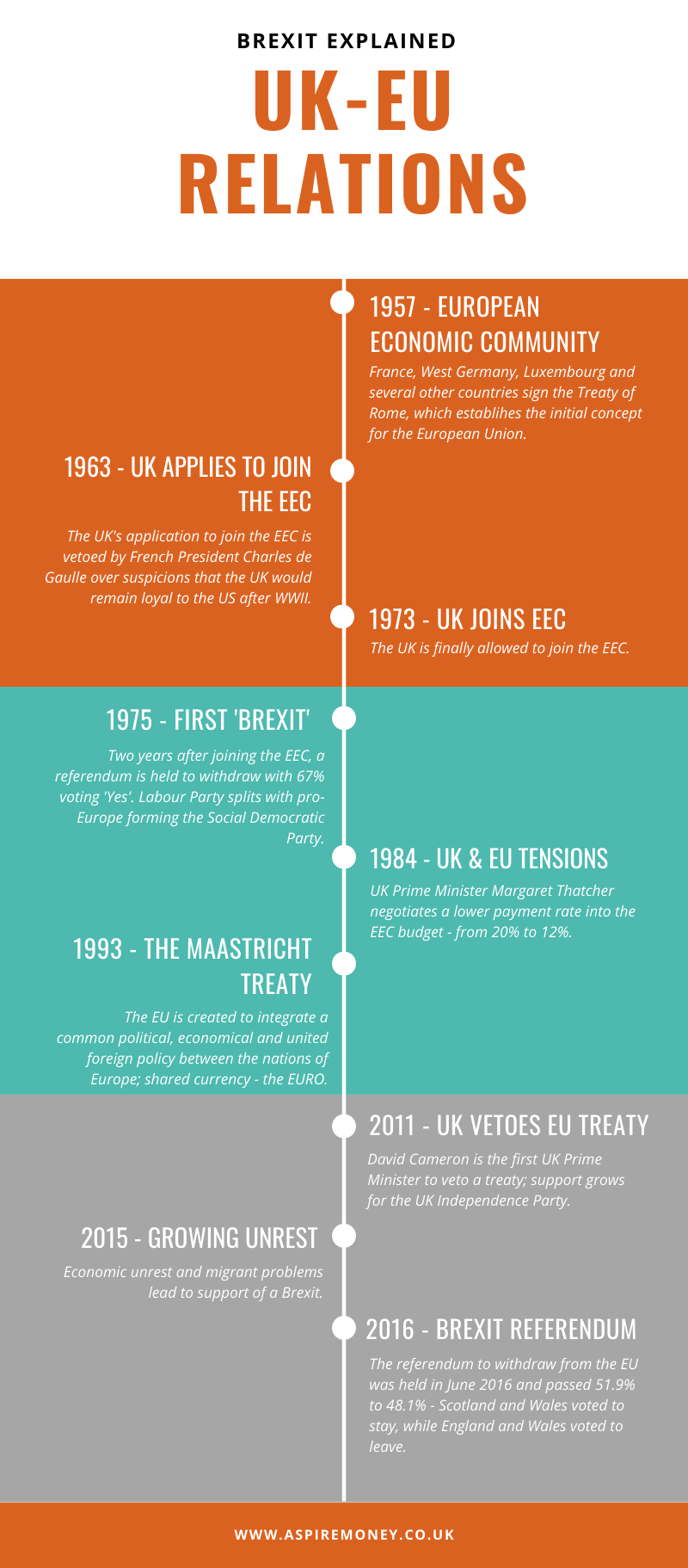

The relationship between the United Kingdom and the European Union has been a precarious one since the uncertain times after World War II, and in the near six decades that have passed since then, differing political and trade ideologies has seen the UK become a predominantly self-contained, if not resistant, member of the EU. This is not the first time members of the leading political party of the UK has put forward notions of a ‘Brexit’, though it is the closest the UK has come to exiting the EU since 1975...

What is Brexit?

Brexit, a term created by chairman of the British Influence Peter Wilding, and which is a portmanteau of the words ‘British’ and ‘exit’, describes the withdrawal of the United Kingdom from the European Union. The decision to leave was put to a public referendum on the 23rd of June 2016, in which more than 30 million people voted. The vote passed 52% to 48%, with the vote to leave succeeding and officially beginning the exit of the UK from the EU.

Why Did Brexit Happen?

There are many reasons behind the withdrawal of the UK from the EU, and they span long before the referendum held in 2016. To completely understand the vote for Brexit, one must first know the history between the UK and the EU…

Since the UK joined the EU in 1973, many Prime Ministers have tried to negotiate better terms for the country in an effort to improve the lives of UK citizens, as well as to gain more favourable terms as a member of the EU. Though the referendum held in 2016 passed, it was a slim win - meaning that many UK residents did not want to leave the EU. However, the majority ruling indicated that many believed that the benefits of belonging to a unified monetary body no longer outweighed the costs of free movement of emigration, which has been a primary tenet in the Brexit movement for several years.

As of 31 January 2020, the UK has begun its exit from the EU. Though its exit will not be immediate - a ‘transition phase’ will take place between now and 31 December 2020 to allow for negotiations - it is worthwhile to understand how this move will impact the UK economy.

What Are The Implications of Brexit on the UK Economy?

Ex-Prime Minister Theresa May invoked Article 50 and put forward an initial withdrawal agreement in 2017, though it was declined by the EU. The new Prime Minister, Boris Johnson, put forward his own agreement - though it is very similar to that of May’s. However, his agreement was accepted and the Agreement Act will implement the agreement negotiated between the UK and the EU over the next few months.

The UK may be facing the following implications once Brexit is entirely complete:

- - a new negotiated trade agreement could increase tariffs and lead to a rise in inflation

- - constraints placed on immigration may negatively impact Britain’s labour force

- - the UK will be forced to pay billions in euros for its ‘divorce bill’ - this is the sum owed by the UK to settle its share of the financing obligations it undertook during its time as a member of the EU

- - Scotland, which was predominantly against leaving the EU, may now opt to leave the UK and rejoin the EU

- - costs of travel and communication may face an increase.

In addition to these potential changes above, the UK and EU must negotiate the following areas during the transition period:

- - elements of law enforcement and security, as well as data sharing

- - standards of aviation and its safety

- - access to fishing waters

- - the licensing and regulation of medicine

- - the supply of electricity and gas.

The Financial Future of the UK, After Brexit

Prime Minister Boris Johnson has displayed great enthusiasm for the future of the UK outside of the EU, and has promised to ‘level up’ the economy - though sceptics and experts have said that it will take more than a decade to complete his plans, and that they would actually only have a minimal impact on the current state of the UK’s productivity levels. They have also warned that a rapid increase in spending could drive up inflation rates, and that while employment is at a high, labour shortages could inhibit governmental plans. UK residents may just have to keep a careful eye on developments during 2020 as the UK and EU finalise their separation, as well as how the government handles any hurdles that arise during the period.