Our growing panel of financial firms may be able to assist customers of all credit types, from those with bad or poor credit history to excellent credit ratings.

Representative Example: Annual Interest Rate (fixed) is 49.5% p.a. with a Representative 49.5% APR, based on borrowing £5,000 and repaying this over 36 monthly payments. Monthly repayment is £243.17 with a total amount repayable of £8,754.12 which includes the total interest payable of £3,754.12.

The % APR rate you will be offered is dependent on your personal circumstances.

Easy 4 Step Process

Aspire Money is a credit broker and we will assess your loan enquiry, based on the information you have provided, to establish your general suitability against our panel of lenders product criteria. We will call you to obtain any further information that is required for certain products and lenders and introduce you to that company. Unlike many other companies, we will not charge you a fee, our service is completely free.

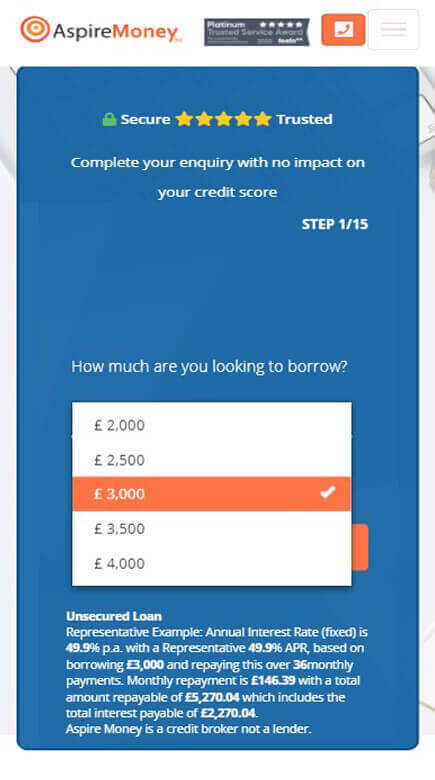

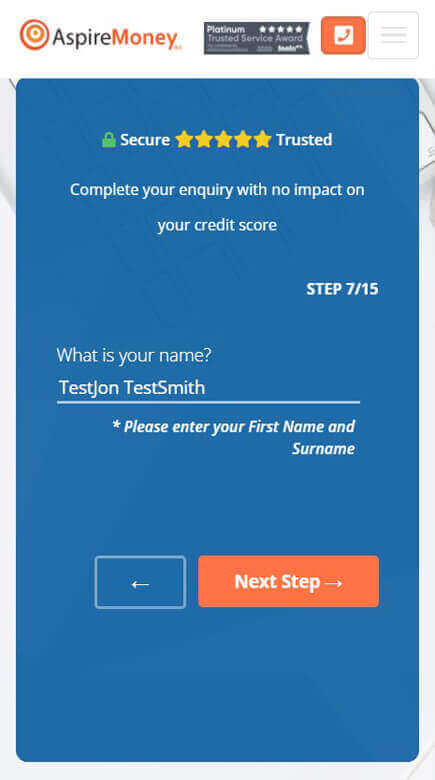

STEP 1

COMPLETE THE ONLINE ENQUIRY FORM

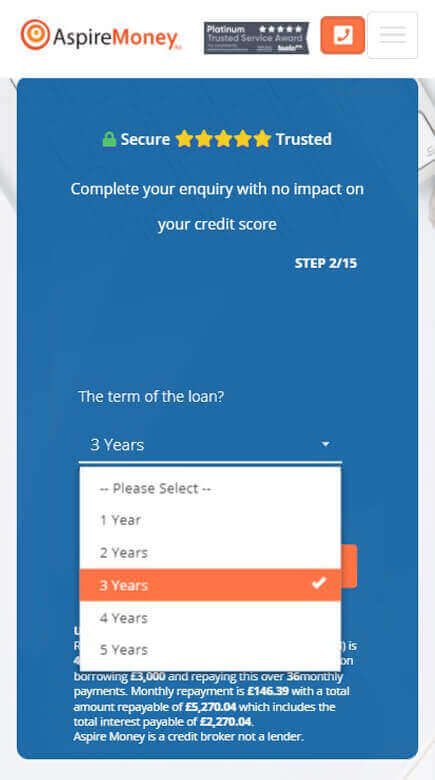

STEP 2

WE WILL CALL YOU TO DISCUSS YOUR LOAN ENQUIRY

STEP 3

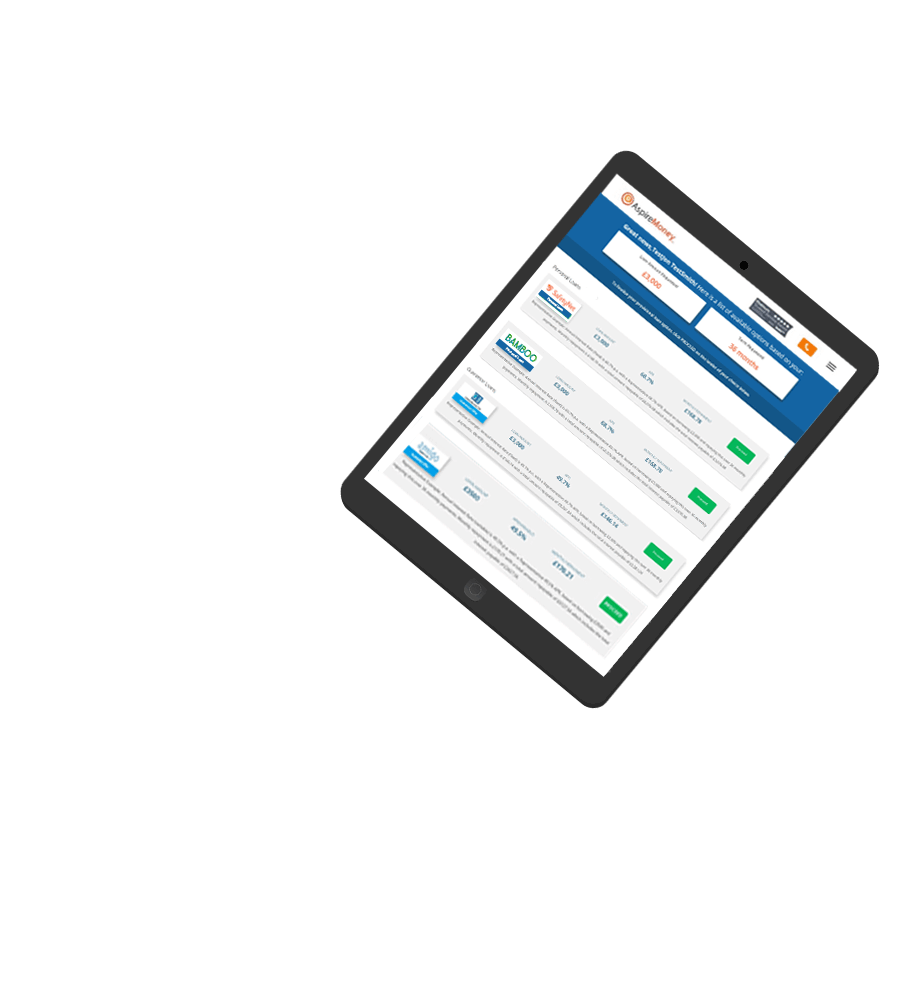

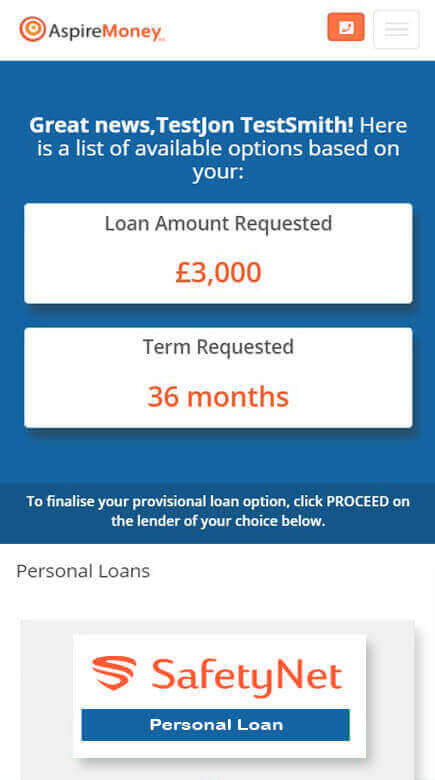

WE WILL REVIEW OUR PANEL OF LENDERS PRODUCTS TO FIND YOU LOAN OPTIONS

STEP 4

WE PROVIDE YOU WITH THE LOAN OPTIONS, YOU DECIDE THE RIGHT OPTION FOR YOU

No Hidden Costs

Our service is completely free so you don’t have to worry about fees.

Bad Credit Loans

We can even help those with bad credit, CCJs, defaults and late payments accepted.

Great Customer Service

Our customer service is rated Gold Trusted Service by Feefo and our experienced consultants are on hand to offer support five days a week.

Self-Employed Loans

We can also source loan options for self-employed customers.

Options Available

We work with a panel of lenders to source loan options that meet your requirements.

Fast Online Enquiry

With our simple online enquiry process, you can apply for a loan in minutes.

Please note, all loan options are based on the information you provide, inaccurate or incomplete information will lead to the option being withdrawn, amended or delayed.

Why Aspire Money

Since 2010, Aspire Money has helped people across the UK find affordable loans to suit their individual circumstances.

We make the process of applying for finance as simple and straightforward as possible, and each month, we help thousands of people narrow down the options available to find the best loan for their needs.

Working with our panel of lenders, we pride ourselves on going the extra mile to get you the money you need as quickly as possible. Once you have submitted a fully completed application we will send this to our lenders and email the preliminary decision to you and any options that might be available.

Aspire Money is a registered credit broker that is authorised and regulated by the Financial Conduct Authority (FCA) and a member of the Consumer Credit Trade Association (CCTA). Our panel of lenders will review your current circumstances to ensure that you will be able to pay back the loan and the interest accrued.

No Hidden Costs

Our service is completely free so you don’t have to worry about fees.

Bad Credit Loans

We can even help those with bad credit, CCJs, defaults and late payments accepted.

Great Customer Service

Our customer service is rated Gold Trusted Service by Feefo and our experienced consultants are on hand to offer support five days a week.

Self-Employed Loans

We can also source loan options for self-employed customers.

Options Available

We work with a panel of lenders to source loan options that meet your requirements.

Fast Online Enquiry

With our simple online enquiry process, you can apply for a loan in minutes.

Please note, all loan options are based on the information you provide, inaccurate or incomplete information will lead to the option being withdrawn, amended or delayed.

Our Service Is Free

Access To A Panel Of Lenders

No Impact On Your Credit Score

UK Secure Website

They were great and helpful throughout the entire process. The looked at my needs and what would the best plan be for me and helped set up a payment plan specified for my life. Would recommend them.

Sara WIlliamson

I have never used this type of personal loan before and even never heard of this company before. But decided to use them because they came through a search of personal loans using a credit score service. They were the first option. The managed to get me an appointment a couple of hours later. I did not get ALL the amount I requested however, I received the best financial advice I wish I had received before - at least from my own bank!!!

John Armstrong

From the beginning they maintained a high level of service and professionalism. Very conveniently located, kind and welcoming staff. They made me feel human when I attended the face to face meeting and understood myself and my situation without judgement. I would highly recommend and encourage to anyone who needs personal help with their financial status.

Stephine John

Aspire Money Can Help You Obtain A Loan

Aspire Money is a registered credit broker that has lenders on a panel to help find you a loan that suits your needs and budget.

Lenders on our panel offer personal loans, unsecured loans and homeowner loans, even if you have bad credit*!

Our online forms are easy to complete and can provide you with a decision in minutes.

*Subject to Terms and Conditions

-

LOAN REPAYMENT PERIOD BETWEEN 1-5 YEARS

-

LOAN AMOUNTS UP TO £25,000

-

MIN APR 6.4% UP TO MAX OF 1611%

July 14, 2020

How To Save Money During Covid-19

The Covid-19 pandemic has affected every person in some way and one of the biggest ways is financial. We’ve all had to pause a bit before reaching for our wallets in this very unstable time. Luckily, we’re all in this together and Aspire Money has compiled effective ways you can save some money during this challenging time.

Read More

April 28, 2020

Bad Credit Loans: What Are They and Can You Get One?

A bad credit score or an unhealthy credit report is not an uncommon thing. In fact, according to Experian, UK residents who are 18 or 19 average a better credit score than people in their late twenties, as well as people in their thirties and forties! Research also shows that many only recover the healthy credit score they had in their adolescence when they reach their forties - but ...

Read More

Aspire Money Ltd

Contact Address:

PO BOX 15799, Solihull, B93 3GA

Registered Address:

Unit 1, Castle Court 2, Castle Gate Way, Dudley, DY1 4RH

Telephone Number:

0203 915 9991

If you are interested in becoming an intermediary please contact:

intermediaries@aspiremoney.co.uk

Mon-Thu: 9am to 7pm

Fri: 9am to 6pm