Bad Credit Loans: What Are They and Can You Get One?

A bad credit score or an unhealthy credit report is not an uncommon thing. In fact, according to Experian, UK residents who are 18 or 19 average a better credit score than people in their late twenties, as well as people in their thirties and forties! Research also shows that many only recover the healthy credit score they had in their adolescence when they reach their forties - but those suffering with a poor credit rating should not despair as some lenders will lend to people with a poor credit rating, as long as its affordable to the customer and they meet the lending criteria.

What Is a Bad Credit Loan?

Bad credit loans can provide relief to those struggling with a credit report that limits their borrowing options. A bad credit loan is a personal loan: the bank or credit lender lends you a certain amount of money, which you pay back every month in fixed instalments with interest.

A bad credit loan can be secured or unsecured; if you successfully apply for a secured loan, it means that your loan is tied to an asset like your home, and if you are unable to keep up with repayments, the asset could be repossessed by the lender. An unsecured loan is one that isn’t secured against an asset and instead the lender has based its decision to lend to you on the basis of your credit report, consideration of other debts, application details and other factors according to its lending criteria.

People with a bad credit rating might be offered a Bad credit loans on the condition that they can find a guarantor. A guarantor can be a friend, family member, or someone close to you who can sign surety when you apply for a loan. Their personal financial history will also be assessed during the loan application process, and they will be held liable for payment on a loan if you default on your instalments.

What is a Bad Credit Score?

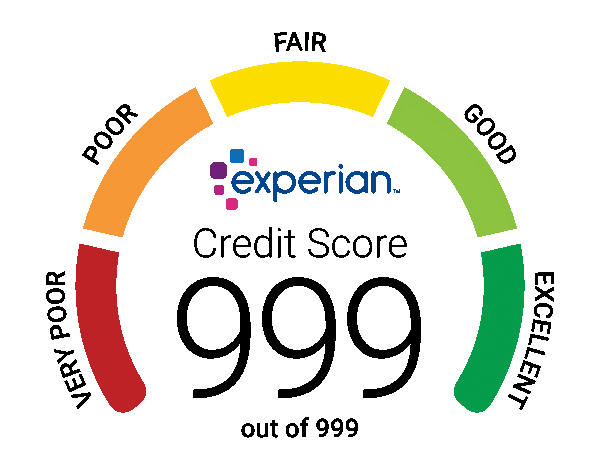

A credit score is regarded as bad or poor when your credit report reflects a rating of anything below 720 (on the Experian scale). A bad credit score is a result of:

- ● late payments on existing credit instalments

- ● missed or skipped payments on existing credit instalments

- ● ‘written off’ credit (when a credit lender assumes you will not be paying off your debt and ‘writes it off’)

- ● having an existing credit account handed to a collection agency after non-payment

- ● defaulting on a loan

- ● high or maxed-out credit card balances

- ● applying for several loans or credit cards at once

- ● not having a variety of credit types (i.e. only loans, or only credit cards, instead of both long-term and short-term credit types)

- ● closing credit cards which still have a balance.

While a credit score is only an indicator of your creditworthiness and likelihood of repaying loans, there is a general range of what is considered a ‘good’ credit score. According to Experian, those with a credit score of between 721 and 880 are considered to have a fair credit score, while those with a credit score of between 881 and 960 are seen to have a good credit score.

How a Bad Credit Score Affects Your Borrowing Options

Your credit score determines how likely lenders are to approve your credit applications. It is a determination of your ability to repay borrowed money, your spending habits, and your general financial behaviour. This means that a bad or poor credit score can negatively impact your chances of getting approved for a loan, as it indicates poor financial habits.

Individuals with healthy credit scores and appealing credit records will receive better interest rates and loan terms than those with poor credit scores. Those with poor credit scores may see very high interest rates, disagreeable loan terms, or even face rejection- which can further tarnish their credit record.

How Can You Obtain a Bad Credit Loan?

There are a variety of different lenders for those looking to borrow, but each have their own lending criteria - which can make obtaining a loan a difficult task for those with bad credit. However, there are steps you can take if you are trying to get a bad credit loan:

- ● consistently work on improving your credit; even if you don’t manage to obtain a loan, you should aim to have a healthy credit record!

- ● create a budget to assess what you can afford

- ● regularly monitor your credit report on free reporting sites like Experian or ClearScore, which can also assist you in sourcing potential loans.